Tax Rate Malaysia 2018

What is income tax.

Tax rate malaysia 2018. Income tax rate malaysia 2018 vs 2017 for assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. Malaysia taxation and investment 2018 updated april 2018 1 1 0 investment climate 1 1 business environment malaysia is a federated constitutional monarchy with a. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

Malaysia personal income tax rate. Non resident individuals pay tax at a flat rate of 30 with. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019.

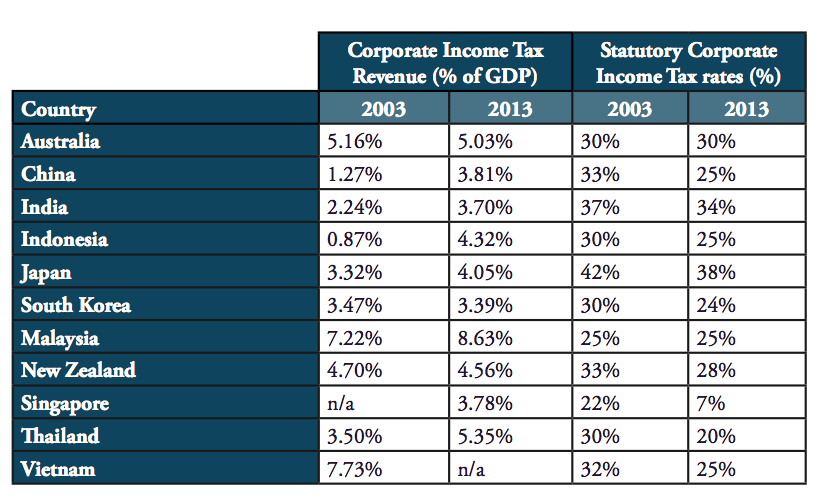

Malaysia corporate tax rate 2018. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower. An organization or corporate regardless of whether occupant or not is assessable on wage gathered in or got from malaysia.

Income attributable to a labuan business. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Following the announcement of the re introduction of sales and services tax sst that will kick start on 1 september 2018 the royal malaysian customs department rmcd has recently announced the implementation framework of sst as well as a detailed faqs to arm malaysians with sufficient knowledge of the new tax regime before sst commence.

On the first 5 000 next 15 000. Rate tax rm 0 5 000. Calculations rm rate tax rm 0 5 000.

4 tax information you need to know. Malaysia sales tax 2018. Useful reference information for malaysia s income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form and may 15 2018 e filing.

As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. On the first 5 000. On the first 5 000.

Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Income tax is a type of tax that governments impose on individuals and companies on all.

Malaysia has adopted a territorial system to pay corporate tax rate.